The seniors housing and care sector at its core is an industry focused on the wellness of people. Due to this focus, many owners and operators in the space perform environmental social and governance (ESG) activities without even realizing it.

The term “ESG” was coined to help measure the sustainability and societal impact of an investment. In recent years, ESG has become a large part of institutional commercial real estate investing, as investors are able to realize returns through quantifiably positive financial, environmental and societal impacts. As the world around us constantly changes and various challenges present themselves, it is important that those in the healthcare real estate industry have a clear understanding of ESG practices and the benefits. In this article, we provide an overview of ESG from a real estate perspective, exploring how owner/operators can best understand, identify and enact these practices to maximize stakeholder financial and environmental impacts.

What is ESG?

ESG can be defined as a “consideration of environmental, social and governance factors alongside financial factors in the investment decision-making process.” The practice of ESG within a firm can mean a number of different things; ranging from promoting well-being of employees, residents, and communities; to environmental and social initiatives; to promoting diverse and equitable hiring practices. As an investor, there are numerous ways a seniors housing or skilled nursing facility can implement ESG practices.

Below is a partial list of ESG items that can be implemented at the property and operating company level:

Environmental:

- LED lighting retrofits

- Solar panels

- Xeriscaping

- Low-flow appliances

- Community gardens

- Composting program

- Green cleaning materials

- Energy Star or LEED programs

- Recycled building materials

- Waste management

- Air quality measures

Social:

- Facility farmer’s market

- Tenant engagement activities

- Community interaction

- Diversity hiring and inclusiveness

- Clothing, food and blood drives

- Utilizing local vendors

- Inter-generational programs

- Partnering with non-profits or local businesses to provide tenant services (i.e. taxes, financial planning, wellness programs such as yoga)

- Business/community improvement districts (BIDs/CIDs)

Governance

- Implementing strategies to record and report ESG initiatives

- Creation of ESG policies facility- or corporation-wide

- Diversity of leadership and board of directors

- Fair and equitable pay of employees

- Risk management and pandemic plans

- Impact measurement

- Culture implementation

It is important for owners and operators to select the appropriate strategy and record efforts they make with ESG investing. Tracking ESG is important as it allows parties to quantify and recognize their efforts and returns.

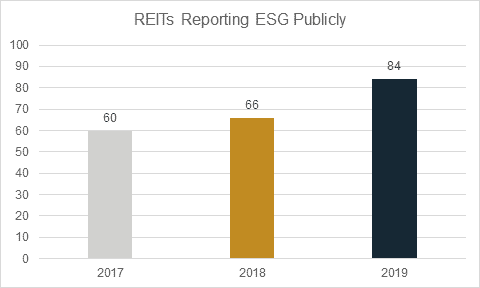

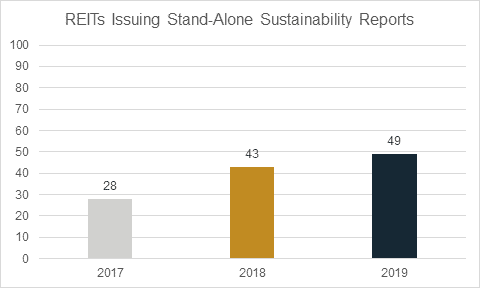

REITs According to Nareit, in 2019, 84 of the top 100 real estate investment trusts (REITs) reported publicly on their ESG efforts, including on their company websites, annual reports and/or stand-alone sustainability reports. Of these top 100 REITs, 36 of them employed full-time employees dedicated to ESG initiatives. Implementing ESG efforts could help clients market their facility at time of sale to institutional investors, REITs and large companies which have ESG mandates.

As seen above, many of the largest REITs produce sustainability and ESG reports which are available to the public, a trend that has been growing in recent years. In many of the healthcare REIT ESG reports, the messaging from CEOs show that value creation will come from operational excellence and investment in sustainability initiatives, among other things. These reports outline the ESG strategy of the healthcare REITs, how they have invested, and their long-term sustainability goals. Amongst others, Healthpeak, Welltower, and Ventas all noted that a driver in their portfolio performance has been their ESG initiatives which will continue to increase shareholder value.

Cases in Point

Bridges Health has implemented a unique model at a number of its skilled nursing facilities (SNFs) which highlights a social initiative example within ESG. Since 1998, the company has been partnering with schools on inter-generational learning. Nationally recognized for their program, the company currently partners with three school districts to provide inter-generational learning classrooms at the pre-k level. The residents are dubbed “grands” and partner with the students to help engage in learning and development. Under this program, residents and students experience the importance of community, while providing a powerful positive energy to the facility. Utilizing this inter-generational learning model, Bridges is providing a key social engagement item which increases resident retention and improves experience. The program is a great example of an ESG option that many SNFs could implement. By taking the initiative to implement programs like this, owner/operators are able to differentiate themselves which has a positive impact on staff members, residents and the community.

In the current pandemic environment, operators are finding creative ways to engage residents and keep up staff morale. Examples include offering Plexiglas visitation booths for family, resident activity baskets, courtyard concerts and movie nights. These types of investments in response to the COVID-19 pandemic are also great examples of ESG initiatives.

In another instance, Trilogy Health Services has recently invested millions into employee education and retention by partnering with a number of universities in the Louisville area to offer staff continuing education. In addition to educational assistance, Trilogy is offering loan repayment programs for associates. Each participant in 2019 received $1,200 towards their student debt, which totaled a $1.8 million investment on Trilogy’s behalf. Undertaking ESG initiatives like this will be critical for operators going forward, as they compete for well-trained talent in an industry with historically high turnover rates.

Why ESG?

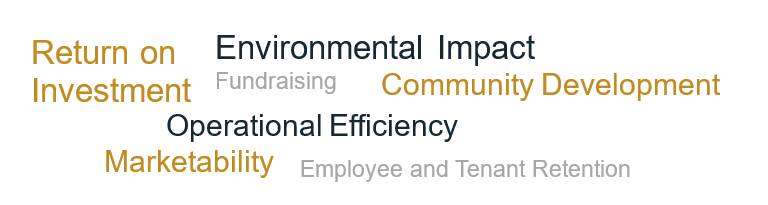

Oftentimes, parties associate ESG with concessionary investing. However, this is not the case when ESG initiatives are actually identified as touched on above. As an owner/operator, focusing on ESG efforts will help reduce operating expenses, increase tenant retention and marketability, and retain and attract talent. In addition to these benefits, being able to present an ESG strategy to potential investors allows for differentiation of owner/operators in the fundraising process. Focusing on ESG provides a competitive advantage that can be relatively cost efficient and implemented quickly.

Real estate affects the world around us as it is first and foremost a people business that builds communities, alters the built environment, and ideally revitalizes entire areas. Focusing on ESG will become increasingly important as we face growing climate risks, environmental changes, pandemics and social shifts. Investing in ESG will shift from a trend for the seniors housing and care sector to a norm. Creating healthier and more desirable facilities that minimize impact on the world around them will be a key for long-term success.

By focusing on ESG, facilities will operate more efficiently, produce higher cash flow, and receive more favorable pricing from the capital markets. A lender with a full suite of advisory services can provide guidance on identifying, highlighting and marketing each owners’ ESG efforts, which will result in better financing terms or a more attractive sales process. As our world further shifts, the owners and operators who focus on ESG will be the ones who will achieve all around superior returns.

Laca Wong-Hammond, managing director, laca.wong-hammond@lument.com

Dominic Porretta, vice president, dominic.porretta@lument.com

Tristan Freshly, associate, tristan.freshly@lument.com

William Pecora, associate, william.pecora@lument.com

Securities, investment banking, and advisory services are provided through OREC Securities, LLC, d/b/a Lument Securities.

Subscribe